This is a four-year program where, after its completion, the students must hurdle and pass the CPA licensure examination (CPALE).

Elevate your career prospects with the Bachelor of Science in Accountancy (BSA) program, designed to equip you with a comprehensive understanding of the financial landscape. This rigorous curriculum covers critical areas such as financial accounting, cost accounting, auditing, taxation, and accounting information systems, ensuring you gain the expertise necessary for success in the ever-evolving finance sector.

Graduates are well-prepared to sit for the Certified Public Accountant (CPA) board exam. unlocking a wide range of professional opportunities in auditing, consultancy, corporate finance, and beyond.

Program Educational Objectives

Graduates of the Bachelor of Science in Accountancy (BSA) Program are expected to have attained the following within 3 to 5 years after graduation:

Graduates of the Bachelor of Science in Accountancy (BSA) Program are expected to have attained the

following within 3 to 5 years after graduation:

- Prepared and analyzed Financial Statements, Financial Reports, Tax Returns, and Annual Reports required by government regulatory bodies and private institutions.

- Maintained professional competence in the practice of Auditing, Accounting, Consultancy, and Taxation through related work experience and Continuing Professional Education.

- Adhered to the professional Code of Ethics for Accountants and ethical codes in the local and international community of accountants.

- Supported sustainable development by conducting accounting research and formulating sound business decisions based on research findings.

- Provided relevant and reliable accounting information that adapted to the changing needs of financial and non-financial information users.

- Conformed to quality assurance standards in the performance of Accounting, Auditing, Consultancy, and Taxation services.

Program Learning Outcomes

A BSA graduate should be able to:

- Resolve business issues and problems, with a global and strategic perspective using knowledge and technical proficiency in the areas of financial accounting and reporting, cost accounting and management accounting and control, taxation, and accounting information systems

- Conduct accountancy research through independent studies of relevant literature and appropriate use of accounting theory and methodologies

- Employ technology as a business tool in capturing financial and non-financial information, generating reports and making decisions

- Apply knowledge and skills to successfully respond to various types of assessments (including professional licensure and certifications); and

- Confidently maintain a commitment to good corporate citizenship, social responsibility and ethical practice in performing functions as an accountant

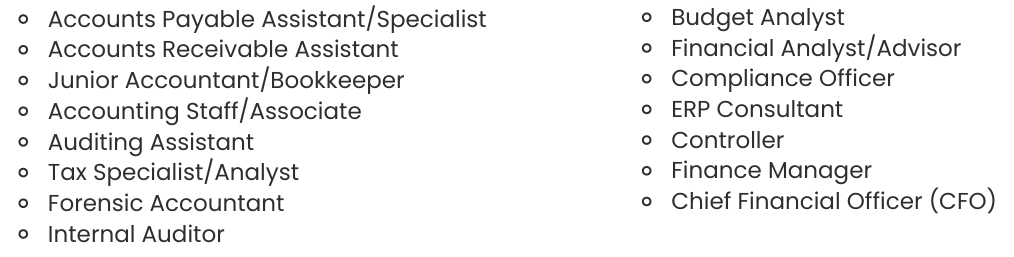

Job Opportunities

BACHELOR OF SCIENCE IN ACCOUNTANCY (CURRICULUM YEAR 2023-2024)

First Year

First Semester – Total Units: 28

| Subject Code | Prerequisite | Description | Units |

| NSTPRO1 | NATIONAL SERVICE TRAINING PROGRAM 1 | 3 | |

| PATHFT1 | MOVEMENT COMPETENCY TRAINING, OR MCT | 3 | |

| SOCORN2 | SOCIAL ORIENTATION | 1 | |

| THSELF1 | UNDERSTANDING THE SELF | 3 | |

| RPHIST1 | READINGS IN THE PHILIPPINE HISTORY | 3 | |

| PRPCOM1 | PURPOSIVE COMMUNICATION | 3 | |

| SCITES1 | SCIENCE, TECHNOLOGY, AND SOCIETY | 3 | |

| COACTG1 | COLLEGE ACCOUNTING PART 1 | 6 | |

| GETHCS1 | ETHICS | 3 |

Second Semester – Total Units: 29

| ENMGMT1 | ENTREPRENEURIAL MANAGEMENT 1 | 3 | |

| NSTPRO2 | NATIONAL SERVICE TRAINING PROGRAM 2 | 3 | |

| PATHFT2 | EXCERCISE-BASED FITNESS ACTIVITY | 3 | |

| CWORLD1 | THE CONTEMPORARY WORLD | 3 | |

| BSSLAW1 | LAW ON OBLIGATIONS AND CONTRACTS | 3 | |

| COACTG2 | COLLEGE ACCOUNTING PART 2 | 3 | |

| HCORDI1 | CORDILLERA: HISTORY AND SOCIO-CULTURAL | 3 | |

| GELECT2 | GENERAL ELECTIVE 2 (GENDER AND SOCIETY) | 3 | |

| GELECT3 | GENERAL ELECTIVE 3 (PEOPLE AND THE EARTH’S) | 3 | |

| MANMGT1 | MARKETING MANAGEMENT | 3 | |

| MANMGT2 | OPERATIONS MANAGEMENT AND TOTAL QUALITY | 3 | |

| MANMGT3 | INTERNATIONAL BUSINESS AND TRADE/BUSINESS | 3 |

Short Term – Total Units: 9

| MANMGT 1 | MARKETING MANAGEMENT | 3 | |

| MANMGT 2 | OPERATIONS MANAGEMENT AND TOTAL QUALITY | 3 | |

| MANMGT3 | INTERNATIONAL BUSINESS AND TRADE/BUSINESS | 3 |

Second Year

First Semester – Total Units: 32

| BSSLAW 2 | BSSLAW1 | BUSINESS LAW AND REGULATIONS | 3 |

| ACCNTG1 | COACTG2 | INTERMEDIATE ACCOUNTING 1 / FINANCIAL | 6 |

| PATFT3B | DARTS | 2 | |

| APSTAT1 | STATISTICAL ANALYSIS WITH SOFTWARE | 3 | |

| ACOMTR1 | IT APPLICATION TOOLS IN BUSINESS | 3 | |

| MATHMW1 | MATHEMATICS IN THE MODERN WORLD | 3 | |

| ARTAPP1 | ART APPRECIATION | 3 | |

| MANSRV1 | COACTG2 | COST ACCOUNTING AND CONTROL/COSTING | 6 |

| FINMNN2 | COACTG2 | FINANCIAL MANAGEMENT 1 | 3 |

Second Semester – Total Units: 29

| BSSLAW3 | BSSLAW2 | REGULATORY FRAMEWORK AND LEGAL ISSUES IN BUSINESS 1 | 3 |

| PATFT4B | BADMINTON | 2 | |

| MANSRV2 | MANSRV1 | STRATEGIC COST MANAGEMENT | 3 |

| FINMNN2 | FINMNN1 | FINANCIAL MARKETS/FINANCIAL MANAGEMENT 2 | 3 |

| ACCNTG2 | ACCNTG1 | INTERMEDIATE ACCOUNTING 2/FINANCIAL | 6 |

| ACCNTG3 | ACCNTG1 | CONCEPTUAL FRAMEWORK AND ACCOUNTING | 3 |

| AUDITG1 | ACCNTG1 | AUDITING AND ASSURANCE PRINCIPLE | 3 |

| AECNMM2 | ECONOMIC DEVELOPMENT | 3 | |

| LRIZAL1 | RIZAL’S LIFE AND WORK | 3 |

Short Term – Total Units: 9

| PROELE1 or BAFTRP1 | ACCNTG1 | VALUATION CONCEPTS AND METHODS (PROF FIELD TRIP) (PROF ELECTIVE) | 3 |

| ACOMTR2 | ACOMPTR1 | ACCOUNTING INFORMATION MANAGEMENT | 3 |

| STRATM1 | STRATEGIC MANAGEMENT | 3 |

Third Year

First Semester – Total Units: 30

| BSSLAW4 | BSSLAW3 | REGULATORY FRAMEWORK AND LEGAL ISSUES IN BUSINESS 2 | 3 |

| ATXATN1 | ACCNTG2 | INCOME TAXATION | 6 |

| MANSRV3 | MANSRV2 | MANAGEMENT SCIENCE/MANAGEMENT | 3 |

| AUDITG2 | AUDITG1 | OPERATIONS AUDITING (PROF ELECTIVE) | 3 |

| AUDITG3 | AUDITG1 | GOVERNANCE, BUSINESS ETHICS, RISK | 3 |

| ACCNTG4 | ACCNTG2 | INTERMEDIATE ACCOUNTING 3/FINANCIAL | 3 |

| ACCNTG5 | ACCNTG2 | UPDATES IN FINANCIAL MANAGEMENT | 3 |

| ACCNTG6 | ACCNTG2 | ACCOUNTING FOR SPECIAL TRANSACTIONS | 3 |

| MANMGT4 | MANMGT3 | ACCOUNTING RESEARCH METHODS/METHODS | 3 |

Second Semester – Total Units: 30

| ATXATN2 | ATXATN1 | BUSINESS TAX | 6 |

| ACCNTG9 | ACCNTG6 | ACCOUNTING FOR BUSINESS COMBINATIONS | 6 |

| MANSRV4 | MANSRV3 | STRATEGIC BUSINESS ANALYSIS (FEASIBILITY) | 3 |

| MANSRV5 | MANSRV3 | MANAGERIAL ECONOMICS/MANAGEMENT | 3 |

| AUDITG4 | AUDITG3 | AUDITING AND ASSURANCE: CONCEPTS AND APPLICATION 1&2 | 6 |

| AUDITG5 | AUDITG3 | AUDITING AND ASSURANCE: SPECIALIZED INDUSTRIES | 3 |

| AUDITG6 | AUDITG3 | AUDITING IN A CIS ENVIRONMENT | 3 |

Fourth Year

First Semester – Total Units: 9

| MANMGT5 | MANMGT4 | ACCOUNTANCY RESEARCH/BUSINESS RESEARCH | 3 |

| INTERNSHIP (ANY OF THE BELOW) |

| AIPRAC1 | ALL FIRST TO | INTERNATIONAL CULTURAL | – |

| AINTRN1 | THIRD YEAR SUBJECTS | ACCOUNTING INTERNSHIP 1 | 6 |

Second Semester – Total Units: 24

| NINTEG1 | INTEGRATED FINANCIAL ACCOUNTING & REPORTING PRACTICE | 4 | |

| NINTEG2 | INTEGRATED ADVANCED FINANCIAL ACCOUNTING | 4 | |

| NINTEG3 | INTEGRATED REGULATORY FRAMEWORK FOR BUSINESS TRANSACTIONS | 4 | |

| NINTEG4 | INTEGRATED AUDITING | 4 | |

| NINTEG5 | INTEGRATED MANAGEMENT ADVISORY SERVICES | 4 | |

| NINTEG6 | INTEGRATED TAXATION | 4 |